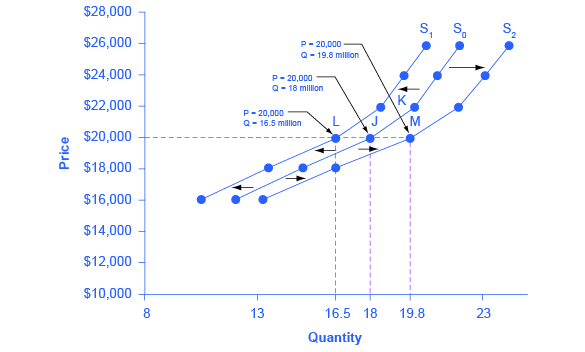

34 the saving schedule shown in the diagram would shift downward if, all else equal,

The saving schedule shown in the diagram would shift downward if, all else equal, consumer wealth rose rapidly because of a significant increase in stock market prices. Refer to the given consumption schedules. DI signifies disposable income and C represents consumption expenditures. All figures are in billions of dollars. The saving schedule shown in the diagram would shift downward if, all else equal, the average propensity to save increased at each income level. the marginal propensity to save rose at each income level. the real interest rate rose. consumer wealth rose rapidly because of a significant increase in stock market prices.

The saving schedule shown in the above diagram would shift downward if, all else equal: A. the average propensity to save increased at each income level. B. the marginal propensity to save rose at each income level. C. consumer wealth rose rapidly because of a significant increase in stock market prices. D.

The saving schedule shown in the diagram would shift downward if, all else equal,

The saving schedule shown in the diagram would shift downward if, all else equal, A. the average propensity to save increased at each income level. B. the marginal propensity to save rose at each income level. C. consumer wealth rose rapidly because of a significant increase in stock market prices.D. the real interest rate rose. Business; Economics; Economics questions and answers; Disposable Income The saving schedule shown in the diagram would shift downward if, all else equal, the average propensity to save increased at each income level. the marginal propensity to save rose at each income level. consumer wealth rose rapidly because of a significant increase in stock market prices. the real interest rate rose. The saving schedule shown in the above diagram would shift downward if, all else equal: A. the average propensity to save increased at each income level.

The saving schedule shown in the diagram would shift downward if, all else equal,. The saving schedule shown in the diagram would shift downward if, all else equal: consumer wealth rose rapidly because of a significant increase in stock market prices. Assume a machine that has a useful life of only one year costs $2,000. the saving schedule shown in the diagram would shift downward if, all else equal. consumer wealth rose rapidly because of a significant increase in stock ... The most important determinant of consumer spending is: ... The saving schedule shown in the above diagram would shift downward if, all else equal:. Which of the following would shift the consumption schedule downward? ... The saving schedule shown in the diagram would shift downward if, all else equal,. Rating: 4 · 1 review

The saving schedule shown in the above diagram would shift downward if, all else equal: consumer wealth rose rapidly because of a significant increase in stock market prices. Refer to the above diagram. At disposable income level D, consumption is: equal to D minus CD. The saving schedule shown in the above diagram would shift downward if, all else equal: C = 40 + .6Yd. Disposable income: $0 100 200 300 400 Consumption: $40 100 160 220 280 Which of the following equations correctly represents the above data? S = -40 + .4Yd. The saving schedule shown in the above diagram would shift downward if, all else equal: A) the average propensity to save increased at each income level.32 pages The saving schedule shown in the diagram would shift downward if, all else equal: asked Aug 18, 2018 in Economics by pix96. A. the average propensity to save increased at each income level. B. the marginal propensity to save rose at each income level.

The saving schedule shown in the diagram would shift downward if, all else equal, A) the average propensity to save increased at each income level. B) the marginal propensity to save rose at each income level. C) consumer wealth rose rapidly because of a significant increase in stock market prices. D) the real interest rate rose. The saving schedule shown in the above diagram would shift downward if, all else equal: A. the average propensity to save increased at each income level. Business; Economics; Economics questions and answers; Disposable Income The saving schedule shown in the diagram would shift downward if, all else equal, the average propensity to save increased at each income level. the marginal propensity to save rose at each income level. consumer wealth rose rapidly because of a significant increase in stock market prices. the real interest rate rose. The saving schedule shown in the diagram would shift downward if, all else equal, A. the average propensity to save increased at each income level. B. the marginal propensity to save rose at each income level. C. consumer wealth rose rapidly because of a significant increase in stock market prices.D. the real interest rate rose.

Sensors Free Full Text Uplink Vs Downlink Machine Learning Based Quality Prediction For Http Adaptive Video Streaming Html

Using Tangible User Interfaces For Teaching Concepts Of Internet Of Things Usability And Learning Effectiveness Emerald Insight

A Two Stage Model For Monitoring The Green Supplier Performance Considering Dual Role And Undesirable Factors Emerald Insight

Chapter 15 Answers To End Of Ch Q Pdf Basic Macroeconomic Relationships Chapter Fifteen Basic Macroeconomic Relationships Answers To End Of Chapter Course Hero

:strip_icc()/shift-in-demand-curve-when-price-doesn-t-matter-3305720-FINAL-71602687e6d54e2a9af7596af2cd231c.png)

0 Response to "34 the saving schedule shown in the diagram would shift downward if, all else equal,"

Post a Comment