33 cash flow diagram calculator

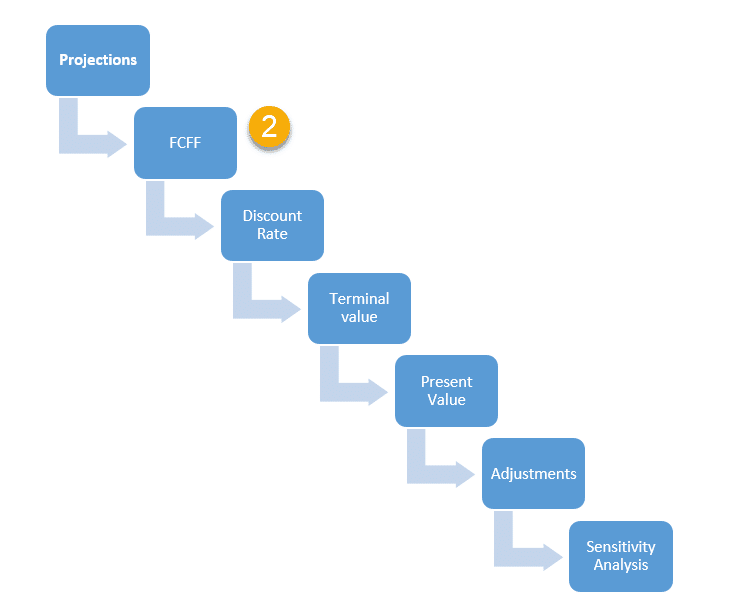

Operating cash flow lets us know how much a company has generated from operations. Now, we can get to the company free cash flow by subtracting investments (i.e. the capital expenditures performed by the company). Free cash flow is what we need in the DCF method in order to estimate the value of the company.

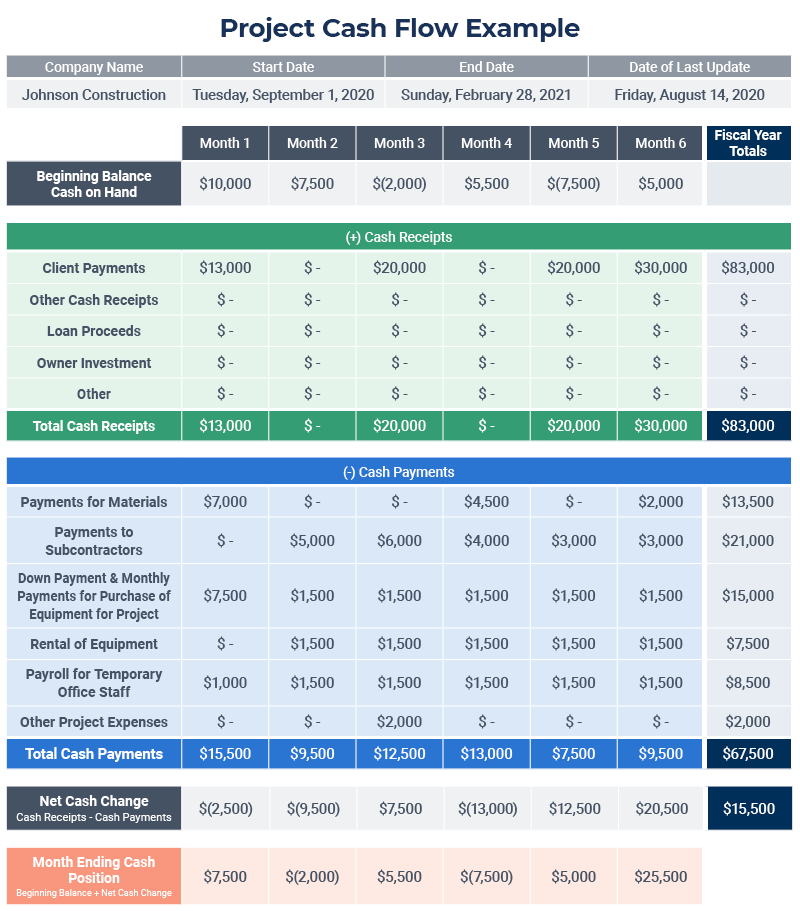

Business owners and entrepreneurs can create cash flow projections by simply using a spreadsheet, document, or software offered by banks. To create a cash flow projection, you'll need to determine the time frame, calculate all revenue and costs, and create a simple chart to fill in all financial data for corresponding months or weeks.

Net cash burn applies in a negative operating cash flow situation. Remember! If you calculate cash burn today, this is a point in time calculation! It changes month-to-month based on invoicing and current expense levels. You can also forecast your cash burn rates to stay ahead of the game. Gross Cash Burn Rate. Gross cash burn does not care if ...

Cash flow diagram calculator

Net cash flow illustrates the amount of money being transferred in and out of a business's accounts. Net cash flow illustrates whether a company's liquid assets are increasing or decreasing. Positive net cash flow indicates that a company can reinvest in operations, pay expenses, return cash to shareholders, and pay off debt.

To calculate free cash flow another way, locate the income statement, balance sheet, and cash flow statement. Start with net income and add back charges for depreciation and amortization. Make an ...

Cash at end of period: Total cash calculated for the end of the period. If this amount is lower than your beginning balance, your business has a negative cash flow. If this amount is negative, you may need to increase your cash flow to maintain your current operations. Received from customers: Cash received from your customers for the period.

Cash flow diagram calculator.

The Cash Flow Scenario - Activities window utilises a Gantt Chart providing you with the ability to schedule when activities occur during the life of the project. The main grid area on the left-hand portion of the window lists each activity in the scenario. If the scenario is based on Cost Schedule items there will be one task name for each ...

Cash position is the projection of cash flow that is forecast for the near term. It's based on the projection of cash receipts from customers that pay outstanding invoices and orders, and also on the projection cash disbursements that are paid to vendors for purchase invoices and orders. When the system predicts customer payments, it uses the ...

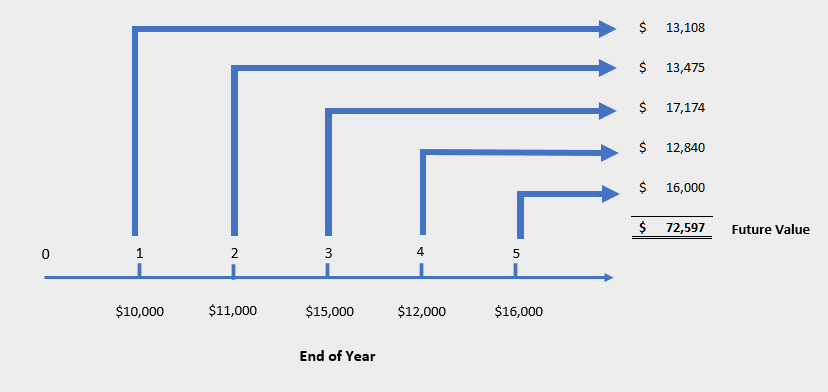

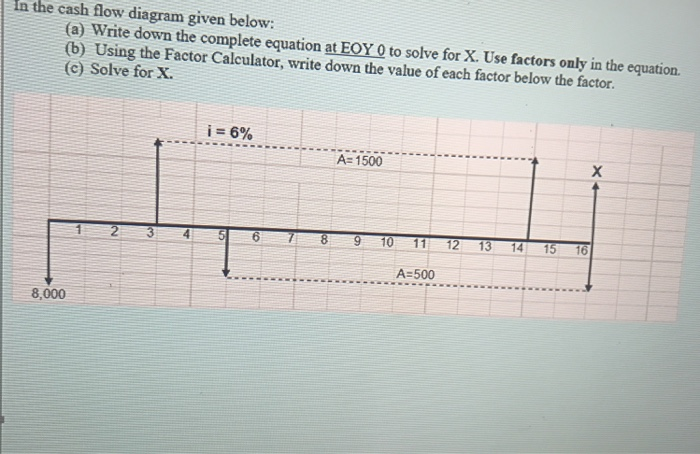

iii) In year 3 you had to pay an additional $10000 to keep the machine going. iv) In year 5 you sold the machine for $20000. a. Draw the cash flow diagram for this problem. b. Calculate the Present Worth (PW) at 10% interest. c. Calculate the Future Worth (FW) at 10% interest. e. Calculate the Annual Worth (AW) at 10% interest.

With the 10bii Financial Calculator, you can: Calculate Time Value of Money (Length of Term, Present Value, Nominal Interest, Loan Payments, Future Value) and see the cash flow diagram produced for you automatically. Values for N, PV, I, PMT, and FV are displayed right above their keys for easy reference, and a special dedicated interface is ...

From this CFS, we can see that the net cash flow for the 2017 fiscal year was $1,522,000. The bulk of the positive cash flow stems from cash earned from operations, which is a good sign for investors.

The operating cycle calculator calculates the period for the working capital requirement during which cash is converted back into cash. This process of converting cash to cash can be explained with the help of the following diagram.

Rental Property Cash Flow Calculator. This calculator figures your real cash flow. It uses mortgage payments, taxes, insurance, property management, maintenance, and vacancy factors. Not only does it allow you to enter your maintenance and vacancies into the calculator, but it also gives you a table with suggested values based on the age and ...

Income Tax Calculator Calculate Income Tax Online Fy 2020 21 . Pin On Iifym Articles Video And Calculators . 1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Calculator Cash Flow Financial Decisions

This calculator will estimate the future value of annuities for you, ... Payment amount (PMT) is the amount paid in or out (cash flow) for each period. Interest rate (r) is the annual nominal interest rate expressed as a percentage. Annuity term constitutes the lifespan of the annuity.

Definition of Cash Flow. Cash flow is the money that comes in and goes out of a company. It is the generation of income and the payment of expenses. Cash inflows result from either the generation ...

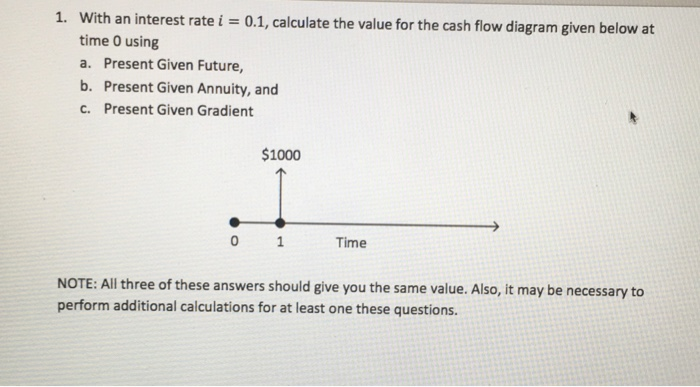

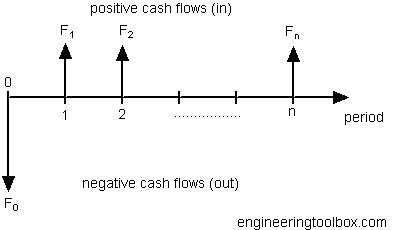

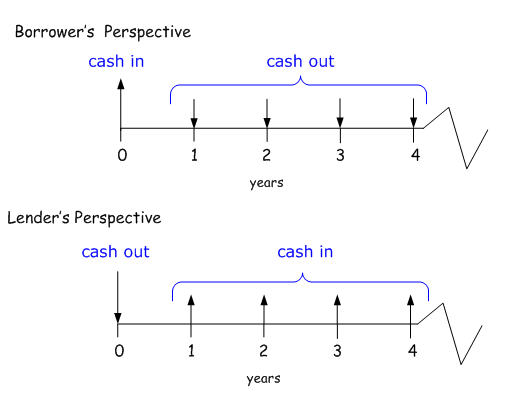

A Cash Flow Diagram helps in visualizing a series of positive values (receipts) and negative values (disbursements) at the discrete period in the clear time. The following below mentioned cash flow diagrams are shown for better clarity (P, F, A ,G) Diagram 1. Single payment cash flow at t=0 Diagram 2.

The GuruFocus DCF calculator can be used to construct a DCF model based on a growth stage, a terminal stage and a discount rate. You can choose to base the DCF model on either free cash flow or earnings per share without non-recurring items. The GuruFocus business predictability rank is shown at the bottom. Using a scale of 1 to 5 stars, with 1 ...

The results are presented to you in a cash-flow diagram. Other calculations that you can easily do with this app include loan payments, mortgage payments, interest rates, and investment value. The financial calculator app is great for finance and business experts, while also being accessible to others who might need a top-performing tool for ...

The cash flow diagram is the most important and essential element of financial analysis. A proper and accurate cash flow diagram should be constructed and tested before an attempt is made to perform the financial analysis. Indeed, with today's special handheld calculators and personal computer spreadsheets, the financial analysis is completed ...

This example describes how to set up, calculate, and view a cash flow forecast for a sales account. Click General ledger > Setup > Chart of accounts > Chart of accounts. Select a chart of accounts. Select a main account that has a main account type of Asset and then click Edit on the Main accounts tab. Select Companies in the Select the level ...

So, let's learn how to calculate profitability index in excel. First, create the distribution of future cash flows, initial investment and set a discounting rate which is the cost of capital. The initial investment is negative because the first cash flow is going out.

The retirement cash flow diagram reminds me of Thomas Picketty's new book, Capitalism in the 21st Century, where he argues that the people with this kind of cash flow are going to continue to grow wealthier as time goes on because wage-related economic growth will be slower than asset-related capital growth.

Using the Construction Draw and Interest Calculation Model. The model includes seven tabs - a Version tab, Sources and Uses tab, Budget tab, Gantt tab, Calc-> section separation tab, Interest Calc tab, and Raw Data tab. I'll briefly discuss each tab below. You can also check out a basic video tutorial I recorded showing how to use the model.

("Est" = FCF growth rate estimated by Simply Wall St) Present Value of 10-year Cash Flow (PVCF) = US$3.0b After calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value, which accounts for all future cash flows beyond the first stage.

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Along with balance sheets and income statements, it's one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.. First, let's take a closer look at what cash flow statements do for your business ...

Cash Flow Diagram Generator is a financial tool that helps in analyzing a company's cash flow. It is a tool that is very useful for companies, entrepreneurs and individuals who have a business or project to manage. In this Cash Flow Diagram Generator template, you will be able to see the movement of money in your business.

Formula for net cash flow. Financial professionals calculate net cash flow with the following formula: Net Cash Flow = Operating Cash Flow + Financing Cash Flow + Investing Cash Flow. The above formula is the most typical way to calculate net cash flow because it can be done from a cash flow statement in Excel.

For the cash flows shown table below, evaluate the unknown value, X for an interest rate of 6% compounded annually. Draw the cash flow diagram.....value of 0. Compute the value of n, assuming a 10% interest rate compounded annually?Year Cash Flow Amount 0 0 1 1 2 1 --- 1 n-2 1 n-1 1 n 1 n -35.95. Answer: The value of n is 16.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

:max_bytes(150000):strip_icc()/DiscountedCashFlowsvs.Comparables2-fea4624dffab4bd8bec311cb6d134a2f.png)

0 Response to "33 cash flow diagram calculator"

Post a Comment