36 intentionally defective grantor trust diagram

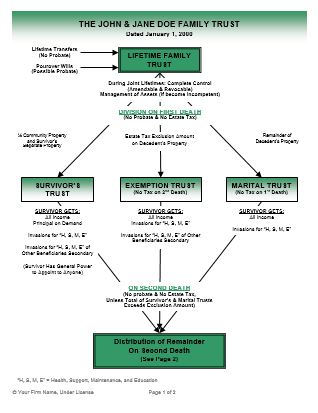

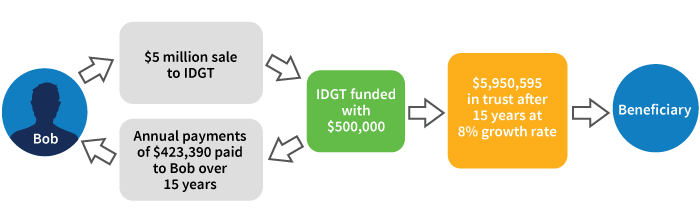

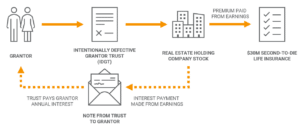

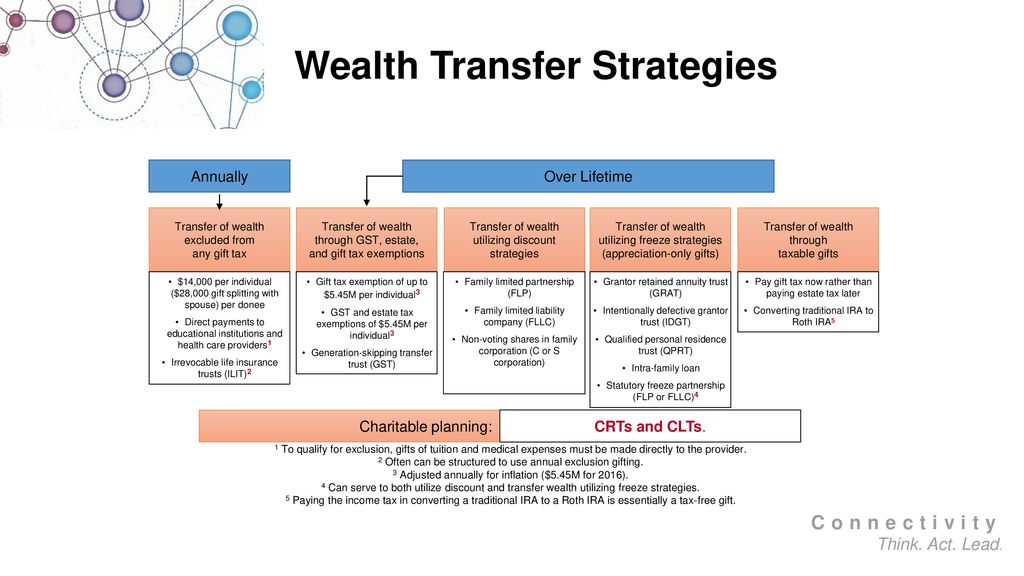

Intentionally Defective Grantor Trust (IDGT) for Dummies. The IDGT is a technique for enhancing the wealth transfer benefits of gifts otherwise made for estate planning purposes. The Internal Revenue Code contains a series of provisions, known as the grantor trust rules. These rules were initially designed to prevent taxpayers from artificially ... An Intentionally Defective Grantor Trust (IDGT) is a trust that is “defective” solely for income tax purposes. The fact that the grantor trust rules are different for income tax and for gift and estate tax creates planning opportunities. For estate and GSST purposes, transfers to IDGTs will be completed gifts and outside the estate.

entity such as a family limited liability company, to an intentionally defective grantor trust ("IDGT"). The Memorandum first presents a brief substantive ...14 pages

Intentionally defective grantor trust diagram

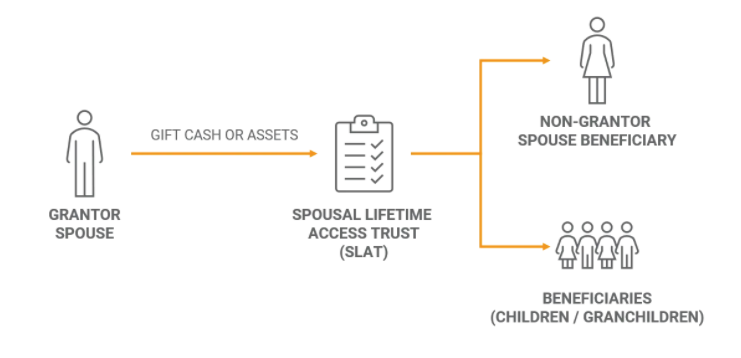

30 Jun 2020 — The effect of an IDGT is to freeze assets for estate tax purposes but not for income tax purposes. “This would be most valuable for a person ... The Spousal Lifetime Access Trust, or “SLAT”, is simply an intentionally defective grantor trust where the Grantor’s spouse is a permissible beneficiary of the trust along with descendants. By including her spouse as beneficiary, the Grantor is able to transfer assets to an irrevocable IDGT but still ensure that the spouse has access to ... 15. Overlooked Consequences of Grantor Trust Status. P. 21 16. Turning Grantor Trust Status On And Off. P. 22 17. Proactive Use Of “Swap” Power. P. 23 18. Grantor Trust Tax Return Obligation. P. 25 19. Installment Sales With Grantor Trusts. P. 26 2 Intentionally Defective (?) Grantor Trusts

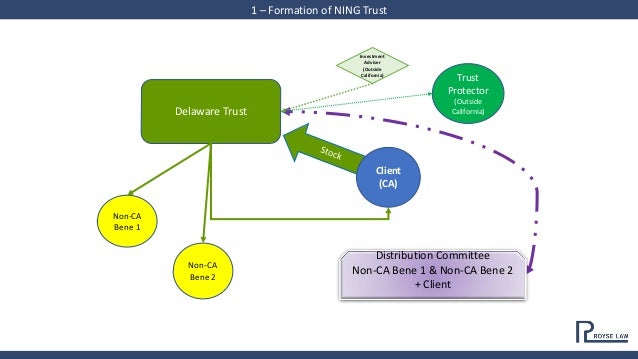

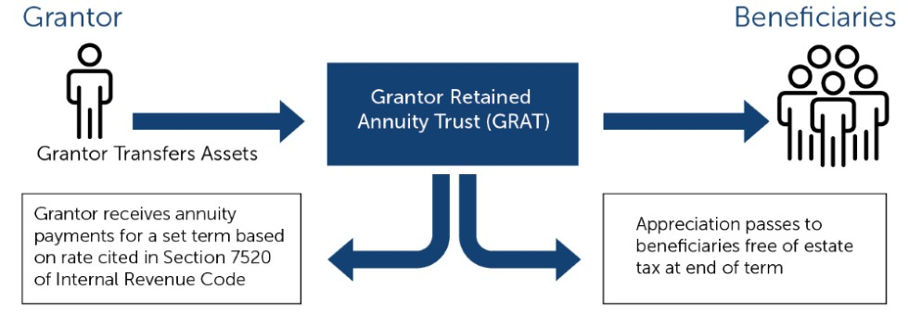

Intentionally defective grantor trust diagram. Intentionally Defective Grantor Trusts (IDGTs) are the premier vehicles for affluent families to transfer their wealth to the next generation. An IDGT is an ...Missing: diagram | Must include: diagram Intentionally Defective Grantor Trusts: Estate Planning with Schrödinger’s Cat. 20 Jan 2020 by Pat Geddie. by James Huang. A popular estate planning vehicle for transferring wealth to descendants during one’s lifetime is the “intentionally defective grantor trust” (IDGT), also referred to as an “intentionally defective irrevocable ... To fund intentionally defective grantor trusts, grantors have two options: make a completed gift to the trust or engage in an installment sale to the trust. A completed gift. Gifts are the most common way to fund an IDGT. The grantor makes an irrevocable, completed gift of the desired assets to the trust. Gifting appreciating assets reaps the ... (a) Intentionally Defective Irrevocable Grantor Trusts – General considerations (1) Understand the difference between Code Sections 2031 through 2042 and Code Sections 671 through 679 (2) Estate tax includability is governed by Code Sections 2031 through 2042. (3) Grantor trust rules are governed by IRC § 671 through 679.

An intentionally defective grantor (IDGT) trust is an estate-planning tool that is used to freeze certain assets of an individual for estate tax purposes, but not for income tax purposes. The ... Intentionally defective grantor trust diagram. According to the tax laws irc 671 679 a grantor trust is any trust in which the trustorgrantor retains control over the income or principal or both to such an extent that he is regarded as the substantial owner of the trust property. What Is An Intentionally Defective Grantor Trust (IDGT)? — “Intentionally defective grantor trust” (IDGT) describes a type of irrevocable trust ... is a grantor trust for income tax purposes, the INTENTIONALLY DEFECTIVE GRANTOR TRUSTS sale of the asset would not result in any taxable gain to the grantor (for income tax purposes, the grantor is considered to be selling an asset to him or herself). There also is no interest in come reported by the grantor or interest deduc tion to the IDGT.

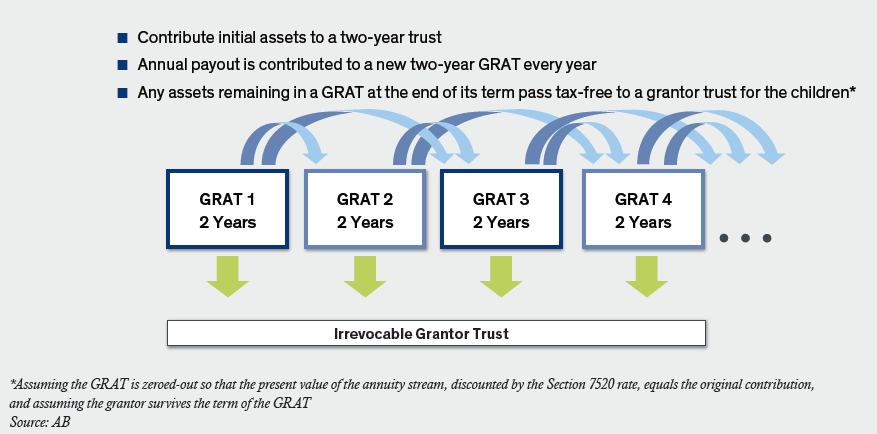

3 Mar 2020 — Grantor Trust Asset Substitution under § 675(4)(c). – Funding GRATs. – IDGT Sales ... Intentionally Defective Grantor. Trust (IDGT) Sale.113 pages 15. Overlooked Consequences of Grantor Trust Status. P. 21 16. Turning Grantor Trust Status On And Off. P. 22 17. Proactive Use Of “Swap” Power. P. 23 18. Grantor Trust Tax Return Obligation. P. 25 19. Installment Sales With Grantor Trusts. P. 26 2 Intentionally Defective (?) Grantor Trusts The Spousal Lifetime Access Trust, or “SLAT”, is simply an intentionally defective grantor trust where the Grantor’s spouse is a permissible beneficiary of the trust along with descendants. By including her spouse as beneficiary, the Grantor is able to transfer assets to an irrevocable IDGT but still ensure that the spouse has access to ... 30 Jun 2020 — The effect of an IDGT is to freeze assets for estate tax purposes but not for income tax purposes. “This would be most valuable for a person ...

Intentionally Defective Grantor Trust Brand Logo Business Some Counterintelligence Targets Crossword Angle Text Logo Png Pngwing

The Covid 19 Pandemic Creates Estate Planning Opportunities Moneta Fee Only Financial Planning Investment Advisors Clients Nationwide

0 Response to "36 intentionally defective grantor trust diagram"

Post a Comment